MOB Real Estate Experts

Healthcare One Properties LLC is a vertically integrated healthcare real estate investment platform with extensive capabilities in acquisitions, underwriting, research, asset management and capital markets, enabling superior investment performance.

Attractive Risk-Adjusted Returns

Value-added approach emphasizing bottom-up, rigorous property-level underwriting coupled with top-down risk policies to achieve index-beating returns

Strong Market Fundamentals

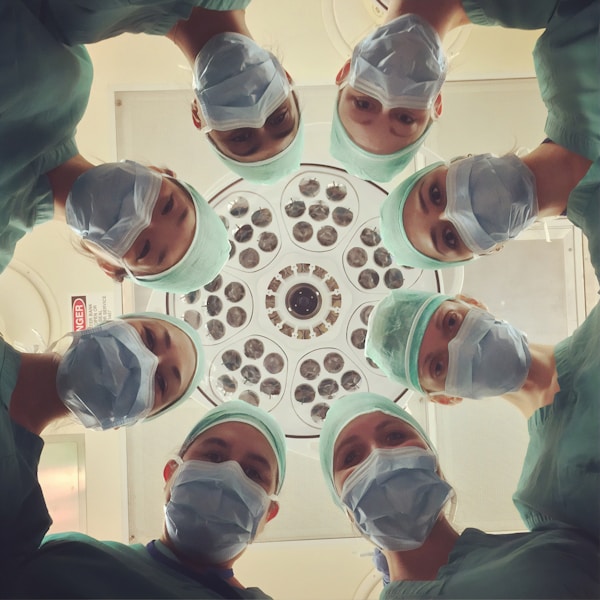

Aging population and shift away from hospitals creates increasing demand for strategically located essential use medical outpatient buildings

Portfolio Diversification

Strong credit tenants, triple net leases, and high dollar tenant build-outs create stabilized sticky tenant base with recession-proof assets

In-House Sourcing Team

Dedicated teams managing strategic relationships to originate off-market and limited market opportunities

National Scale & Infrastructure

Vertically-integrated firm customized for scalability, reliability and accountability with experience in 41 states

ESG Philosophy

Fully integrated ESG considerations into the investment process to examine long-term sustainability risk of portfolio assets